TO RENT OR TO BUY?

SCOTTSDALE, Ariz. – As more people spend their days working from home and creating a work sanctuary with various home improvement projects, it leaves renters wondering if now is the time to upgrade. With mortgage rates at an all time low, some renters would be paying less per month for a home and mortgage as they look into owning a home for a similar price as renting. Actually, rates fell to a historic low 16 times in 2020 which proved to be the push some renters needed to make the switch. Some industry experts have an answer to the burning question for prospects: to rent or to buy?

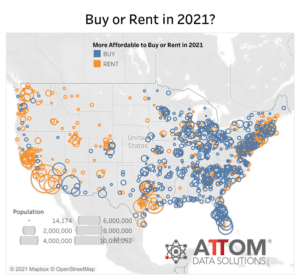

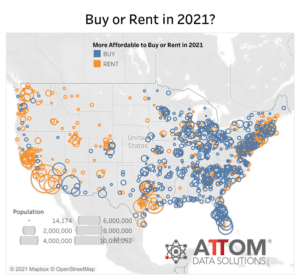

AATOM Data Solutions published an article on “Owning a home more affordable than renting in nearly two thirds of U.S. housing markets” with some key insights that help give some answers to those wondering if now is the time to buy. They stated that it really depends on where you are looking at buying or renting. Owning a mid-priced three bedroom home is actually more affordable than renting a three bedroom property in roughly 63 percent of the country.

“The most populous counties where home prices are rising faster are Los Angeles County, CA; Cook County (Chicago), IL; Harris County (Houston), TX; Maricopa County (Phoenix), AZ and San Diego County, CA,” the article reported. “Among the 44 U.S. counties analyzed in the report with a population of 1 million or more, those where it is more affordable to buy a home than rent include Maricopa County (Phoenix), AZ; Miami-Dade County, FL; Clark County (Las Vegas), NV; Tarrant County (Fort Worth), TX and Broward County (Fort Lauderdale), FL.”

Although prices are starting to rise faster in 2021 in places like Maricopa County, AZ the homes are still more affordable than in years past and those looking to buy a home may see greater benefits than renting.

When it comes to owning a home, some advantages are the great long-term investment, stable-monthly payments, building equity and the freedom to customize or improve your living space at your discretion. On the flip side, owning a home comes with a lot of up-front costs, unexpected maintenance costs and the possibility that the value of the property could decline.

Some advantages to renting a property are that rent is typically lower or more affordable as a whole when you add in utilities, any repairs or maintenance is done by the property management and usually does not come out of pocket for the renter and there is typically lower up-front costs when renting. However, you are usually restricted in the customization of your space, it is also possible your rent could increase or the property management could force you to vacate at their discretion.

Although rates may be low this month, there’s no telling how long it will last. If you think now may be the time to buy, or you are still unsure, contact a My Home Group Agent today who can help by visiting our agent directory here.